When You Want to Give Your Children a Head Start!

An RESP (Registered Education Savings Plan) is a tax-sheltered plan that helps you save for a child’s post-secondary education faster.

There are many things to consider, the best approach is to get the information you need for your personal situation and get started – time is key when it comes to saving for a goal, even smaller amounts over a longer period time can make a difference.

Benefits of a RESP

√ Tax Sheltered Growth

Earnings within an RESP are not taxed. When the funds are taken out for education, withdrawals are taxed in the student’s hands, often resulting in little or no tax.

√ Get Government Contributions

Grow your savings faster with the Canada Education Savings Grant (CESG)1, Canada Learning Bond (CLB)2, and other government incentives.

No matter what your family income, the government pays a basic CESG of 20% on the first $2,500 of annual contributions or a maximum of annual CESG of $500 for each child (beneficiary). If there is unused grant room from a previous year, the maximum CESG in a year is $1,000. The lifetime limit of CESG is $7,200 per beneficiary.

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. No personal contributions to an RESP are required to receive the CLB.

√ Built-in Flexibility

If the child doesn’t pursue post-secondary education, you may be able to choose a new beneficiary. Or, if he or she wants to travel first, you have 35 years to use the funds. If one of the beneficiaries does not attend post-secondary education, the subscriber may be able to transfer the earnings from the RESP to their own Registered Retirement Savings Plan (RRSP) within certain limits.

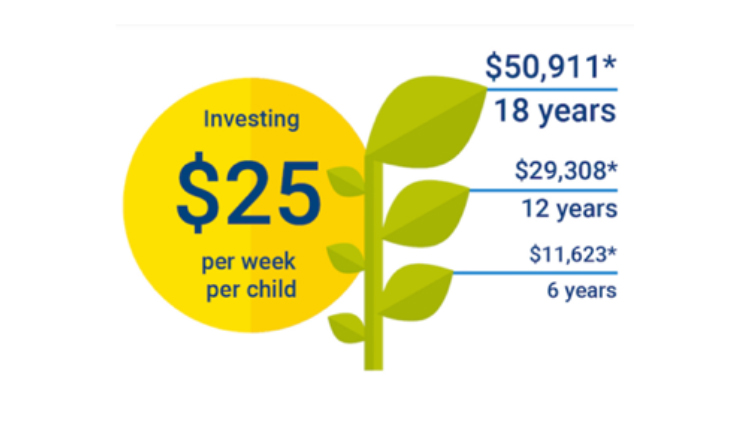

See how contributing $25 per week in an RESP adds up quickly when supplemented by the federal and provincial incentives.

Assumptions Used in Chart: Calculations are for illustrative purposes only and are not intended to reflect future values or returns on investment from any mutual fund investment. Based on 6.26% average annualized and includes Canada Education Savings Grant (CESG) payments.

Jennifer Taylor, CFP®, PFP, Financial Planner, RBC Royal Bank